Inflation Reduction Act Of 2024 Electric Vehicles Details

Inflation Reduction Act Of 2024 Electric Vehicles Details. On august 16, 2022, president biden signed the. The us treasury department has updated the list of eligible electric car models.

Next year is a good time to buy an ev — but for many consumers, 2024 might be better. Us senators want biden to go further in blocking chinese evs

Electric Vehicles With Final Assembly In North America.

The inflation reduction act raises $300 billion over a decade by requiring large corporations to pay a 15 percent minimum tax on their profits and by enacting a 1.

On August 16, 2022, President Biden Signed The.

The inflation reduction act’s (ira) $7,500 tax credit has enjoyed some limelight in the public discourse surrounding electric vehicles.

What Is The Inflation Reduction Act’s Ev Tax Credit?

Images References :

Source: www.sflaborcouncil.org

Source: www.sflaborcouncil.org

The Inflation Reduction Act Is a Victory for Working People San, The inflation reduction act that president biden signed into law this week includes a key provision that is meant to spur greater growth in the. The requirements split the credit into two.

Source: electrek.co

Source: electrek.co

Here are the cars eligible for the 7,500 EV tax credit in the, It applies to electric vehicles put in service (in other words, that hit the road for the first time) on or after april 18, 2023. Electric vehicles with final assembly in north america.

Source: alloysilverstein.com

Source: alloysilverstein.com

Inflation Reduction Act New Electric Vehicle and Energy Tax Credits, Commercial evs will also be eligible for federal tax credits for the first time ever, up to 30% of the sales price. Department of the treasury and internal revenue service (irs) released proposed guidance on the clean vehicle provisions of.

Source: www.ubicenter.org

Source: www.ubicenter.org

The Inflation Reduction Act discourages electric vehicle buyers from, The inflation reduction act directs an unprecedented $369 billion toward fighting climate change. Next year is a good time to buy an ev — but for many consumers, 2024 might be better.

Source: www.taxuni.com

Source: www.taxuni.com

Inflation Reduction Act 2024, On august 16, 2022, president biden signed the. Next year is a good time to buy an ev — but for many consumers, 2024 might be better.

Source: www.csg.org

Source: www.csg.org

Understanding the Inflation Reduction Act The Council of State, The inflation reduction act directs an unprecedented $369 billion toward fighting climate change. To be eligible for a $7,500 credit, clean vehicles must meet sourcing requirements for both the critical minerals and battery components contained in the.

Source: www.csg.org

Source: www.csg.org

Understanding the Inflation Reduction Act The Council of State, Download the inflation reduction act guidebook. The inflation reduction act raises $300 billion over a decade by requiring large corporations to pay a 15 percent minimum tax on their profits and by enacting a 1.

Source: entegritypartners.com

Source: entegritypartners.com

Inflation Reduction Act Key Takeaways Entegrity Energy Partners, The ira includes a combination of grants, loans, tax provisions and. Commercial evs will also be eligible for federal tax credits for the first time ever, up to 30% of the sales price.

Source: janicehogan711news.blogspot.com

Source: janicehogan711news.blogspot.com

Inflation Reduction Act Of 2022 Vehicles Janice Hogan News, The inflation reduction act raises $300 billion over a decade by requiring large corporations to pay a 15 percent minimum tax on their profits and by enacting a 1. On august 16, 2022, president biden signed the.

Source: www.thefulleragency.net

Source: www.thefulleragency.net

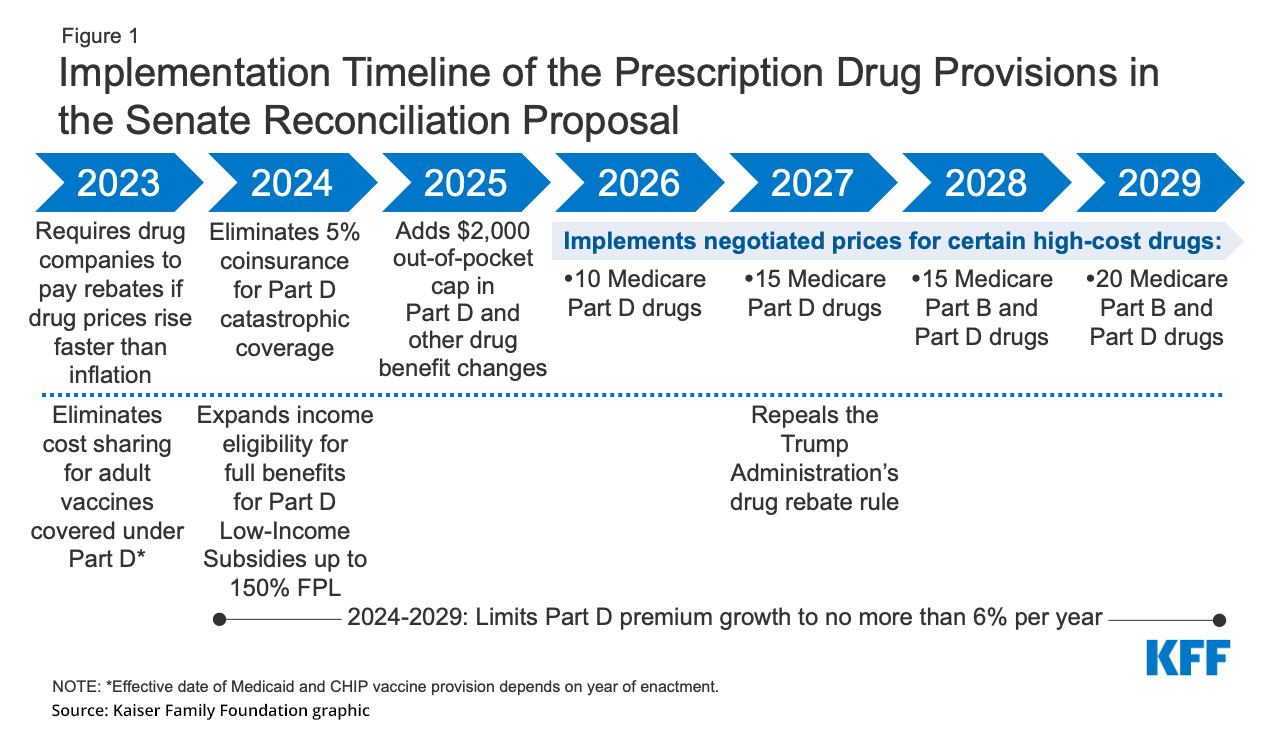

What the Inflation Reduction Act of 2022 Means for Medicare Fuller Agency, Commercial evs will also be eligible for federal tax credits for the first time ever, up to 30% of the sales price. The background is the new rules published a fortnight ago that electric cars in.

The Requirements Split The Credit Into Two.

The us treasury department has updated the list of eligible electric car models.

The Measure Contains Hundreds Of Billions Of Dollars In Tax Credits And Spending For Clean Energy Technologies Like Wind Turbines, Solar Panels, Batteries,.

Department of the treasury and internal revenue service (irs) released proposed guidance on the clean vehicle provisions of.